Understanding the Actuarial Intern Role

An actuarial internship is a crucial stepping stone for aspiring actuaries, offering invaluable practical experience. It bridges the gap between academic knowledge and real-world application within the insurance, finance, and consulting industries. These internships provide opportunities to apply mathematical, statistical, and financial theories to analyze risk, develop pricing models, and contribute to strategic decision-making. Successful completion of an internship significantly enhances a candidate’s prospects in securing full-time actuarial positions after graduation. The actuarial intern role also exposes you to the professional work environment, company culture, and the collaborative nature of actuarial teams.

Key Responsibilities of an Actuarial Intern

The responsibilities of an actuarial intern can vary depending on the specific company and the department they are assigned to, but generally include tasks related to data analysis, model building, and report generation. Interns often assist in the development and maintenance of actuarial models used for pricing, reserving, and forecasting. They may be involved in data validation and cleaning processes, ensuring the accuracy of information used in actuarial calculations. Furthermore, interns frequently participate in the preparation of reports and presentations, summarizing findings and communicating them to both technical and non-technical audiences. They also contribute to the ongoing research and analysis of industry trends, competitor behavior, and regulatory changes.

Essential Skills for Actuarial Interns

Success in an actuarial internship requires a blend of technical, analytical, and communication skills. Prospective interns should demonstrate a strong foundation in mathematics, statistics, and financial modeling. The ability to solve complex problems, interpret data, and apply logical reasoning is crucial. Furthermore, effective communication skills, both written and verbal, are essential for conveying technical information to diverse audiences. Adaptability, teamwork, and a proactive approach to learning are also highly valued. Proficiency in programming languages such as Python, R, or VBA, along with experience with actuarial software, further enhances a candidate’s profile.

Technical Skills

Technical skills are the backbone of an actuary’s work. Interns should possess a solid understanding of probability, statistics, calculus, and financial mathematics. Knowledge of programming languages, particularly those used in actuarial work like R, Python, or VBA, is highly beneficial. Proficiency in using actuarial software, such as Prophet or MG-ALFA, also significantly enhances a candidate’s capabilities. Furthermore, understanding of insurance principles, risk management techniques, and financial reporting standards provides a strong foundation for performing actuarial tasks and contributing effectively to project teams.

Analytical Skills

Actuarial work demands exceptional analytical abilities. Interns must be able to interpret complex datasets, identify trends, and draw meaningful conclusions. The ability to solve problems logically, critically evaluate information, and apply quantitative methods is vital. Furthermore, strong attention to detail is crucial to ensure the accuracy and reliability of actuarial models and reports. Being able to independently conduct research, analyze data, and offer insights helps to improve the models and generate accurate results. The analytical process requires the ability to think logically and identify and address the root causes of issues that arise.

Communication Skills

Effective communication is crucial for conveying complex actuarial concepts to both technical and non-technical audiences. Interns need to be able to clearly and concisely explain their findings, both verbally and in writing. The ability to create well-structured reports and presentations, and to tailor the message to the intended audience, is essential. Strong interpersonal skills, including the ability to collaborate effectively with colleagues and to build rapport with clients, are also highly valuable. Being able to articulate the data and models to the respective parties is essential to the role of an actuary.

Crafting Your Actuarial Intern Cover Letter

Your cover letter is your first opportunity to make a strong impression on potential employers. It should highlight your skills, experience, and enthusiasm for the role. A well-crafted cover letter can significantly increase your chances of getting an interview. Tailor the letter to each specific job application, demonstrating that you have researched the company and understand their needs. Proofread carefully for any errors in grammar or spelling. By taking the time to craft a compelling cover letter, you can showcase your qualifications and make your application stand out from the competition.

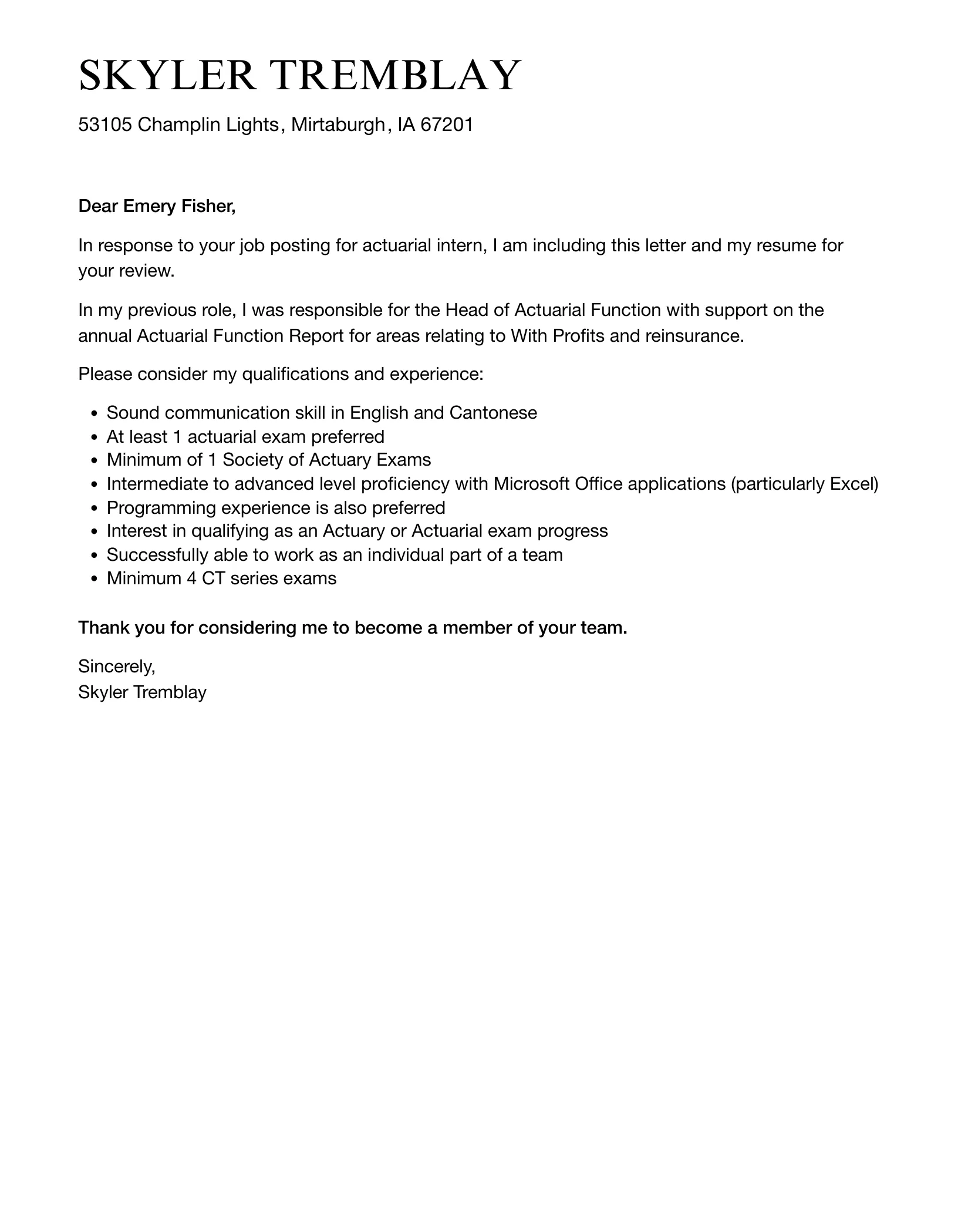

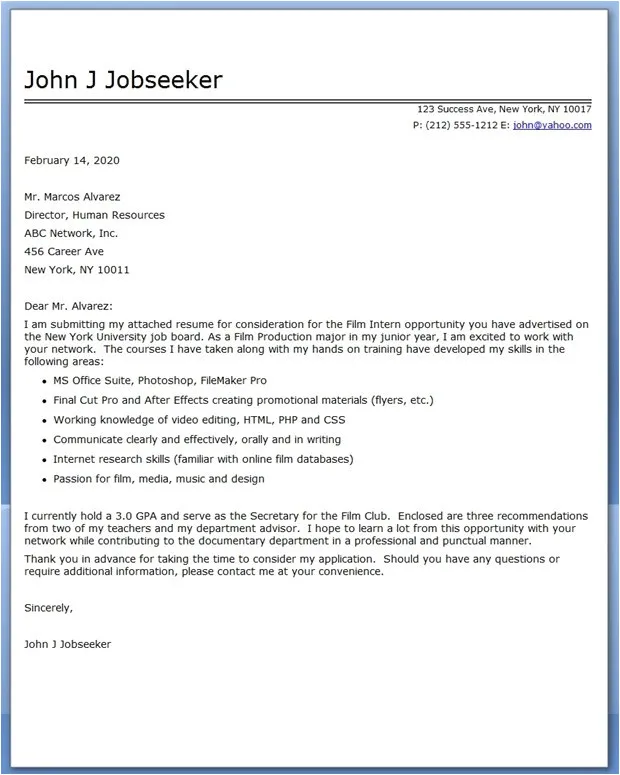

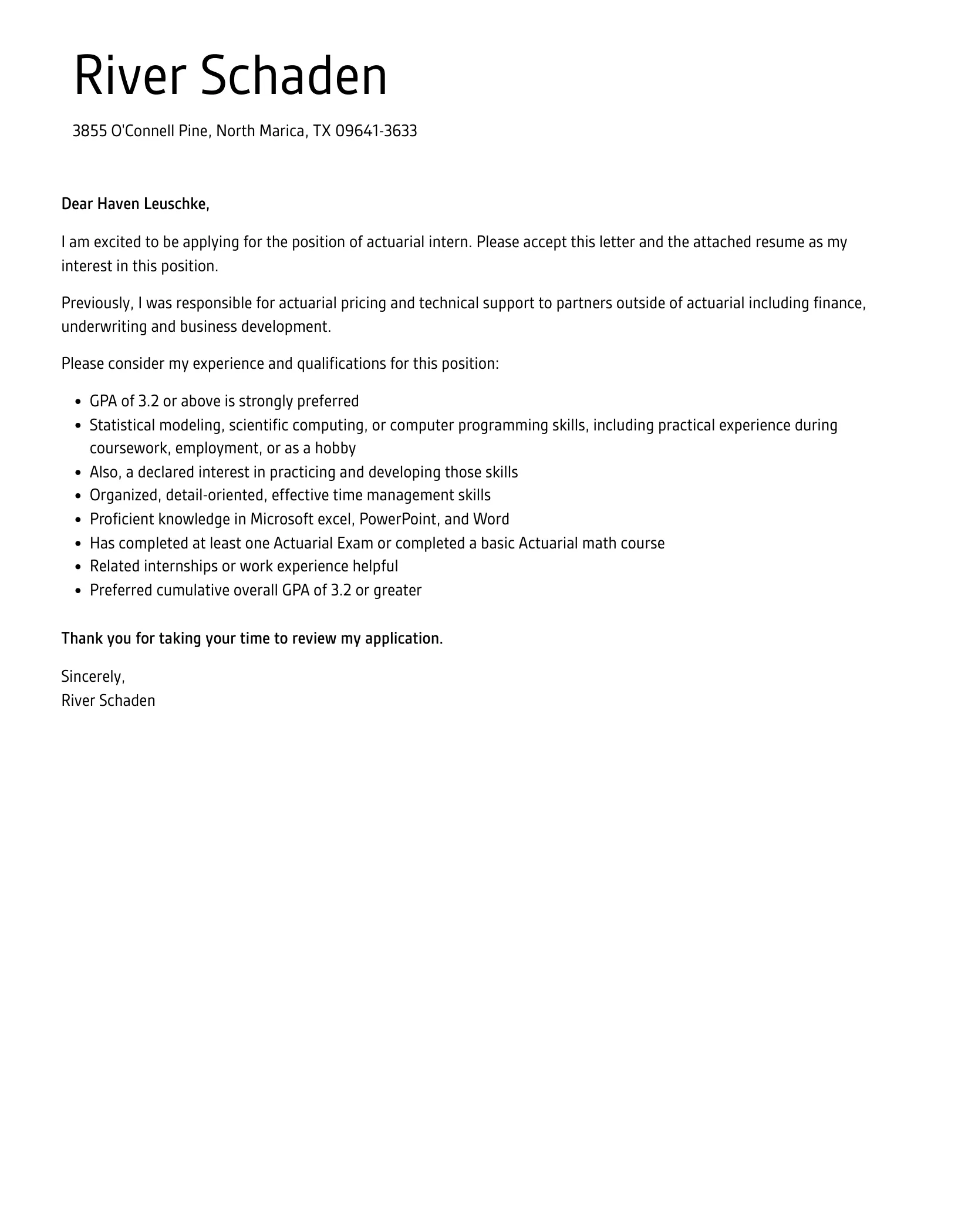

Header and Contact Information

Start your cover letter with a professional header that includes your full name, contact information (phone number and email address), and the date. Include the recipient’s name, title, and company address. Ensure your contact information is accurate and up-to-date. This section provides the employer with immediate access to your contact details should they wish to follow up on your application. Use a clean and professional format for the header, making it easy to read and visually appealing.

Professional Greeting

Address the hiring manager or the specific person mentioned in the job posting by name. This demonstrates that you have taken the time to research the company and are genuinely interested in the role. If you cannot find a specific name, use a professional greeting such as “Dear Hiring Manager” or “Dear [Company Name] Recruiting Team.” Avoid generic greetings like “To Whom It May Concern.” Personalizing your greeting shows respect and attention to detail, setting a positive tone from the start.

Opening Paragraph Capturing Attention

Your opening paragraph should immediately capture the reader’s attention and clearly state your purpose for writing. Mention the specific position you are applying for and where you found the job posting. Briefly introduce yourself and highlight your key qualifications or experiences that align with the role’s requirements. Express your enthusiasm for the company and the opportunity to contribute to their team. Ensure your opening is concise, engaging, and sets the stage for the rest of your cover letter.

Highlighting Relevant Experience

The body of your cover letter should detail your relevant experience, emphasizing skills and accomplishments that align with the job description. Provide specific examples of your past work or projects where you applied actuarial principles. Quantify your achievements whenever possible, using numbers and data to showcase your impact. Focus on the skills and experiences that are most relevant to the internship position. Tailor your description to fit what they are seeking from an intern. Briefly describe your responsibilities and your specific accomplishments to demonstrate your value.

Showcasing Skills and Qualifications

Clearly articulate your skills and qualifications, aligning them with the requirements mentioned in the job description. Highlight both your technical and soft skills, such as analytical abilities, problem-solving skills, communication skills, and teamwork. Provide concrete examples of how you have demonstrated these skills in your previous academic or professional experiences. Use keywords from the job posting to showcase your suitability for the role. This demonstrates that you are the right fit for the company and the position.

Quantifying Achievements

Whenever possible, quantify your achievements to demonstrate the impact of your contributions. Use specific numbers and data to showcase your accomplishments. For example, if you improved the accuracy of a model, state the percentage improvement or the financial benefit. If you worked on a project that saved time or resources, specify the time saved or the cost reduction. Quantifying achievements provides concrete evidence of your skills and value, making a stronger impression on the hiring manager. It helps the hiring manager understand your work and what you achieved in previous positions and/or internships.

Demonstrating Passion for Actuarial Science

Show your genuine passion for actuarial science and explain why you are interested in this specific internship and company. Discuss what motivates you to pursue a career in this field. Describe any relevant projects, coursework, or personal experiences that have sparked your interest in actuarial work. Express your enthusiasm for learning and your desire to contribute to the company’s success. Demonstrate that you are enthusiastic and eager to start a new career. This will show the interviewer that you are motivated to work and are interested in the position.

Expressing Interest in the Company

Show that you have researched the company and understand its mission, values, and recent achievements. Mention specific aspects of the company that appeal to you. Explain why you are particularly interested in working for them. Demonstrate your knowledge of the company’s industry, products, and services. This shows the hiring manager that you have invested time and effort in understanding the company and its values. This also can help show that you are a good fit for their company culture.

Closing the Letter

Conclude your cover letter with a strong closing paragraph. Reiterate your interest in the position and your enthusiasm for the opportunity. Thank the hiring manager for their time and consideration. Express your eagerness to discuss your qualifications further in an interview. Include a call to action, such as stating that you look forward to hearing from them soon. End with a professional closing such as “Sincerely” or “Best regards,” followed by your typed name.

Proofreading and Formatting

Proofread your cover letter carefully for any errors in grammar, spelling, or punctuation. Ensure that your writing is clear, concise, and easy to read. Use a professional font and maintain consistent formatting throughout the document. Format your cover letter in a way that is visually appealing and easy to navigate. Consider using bullet points or numbered lists to highlight key information. Review the formatting to ensure it is consistent and professional. Ensure the content is well-organized and formatted in a way that is easy to read and visually appealing.

Tailoring Your Letter to Each Application

Customizing your cover letter for each specific job application is vital for making a strong impression. This ensures that you directly address the requirements and expectations outlined in the job description. Tailor your letter by highlighting the specific skills, experiences, and accomplishments that align with the needs of the company and the role. Avoid using a generic cover letter that could be sent to any employer. Tailoring shows you’re interested in the company and that you took the time to research the position and their needs.

Researching the Company

Before writing your cover letter, thoroughly research the company and the specific position you are applying for. Visit the company’s website, read industry news, and explore their social media profiles to gain insights into their culture, values, and recent achievements. Understand the company’s mission, the services they provide, and their position in the market. This research will help you tailor your cover letter to demonstrate your understanding of their needs and your genuine interest in the company. This research can help you to better prepare yourself for the interview process as well.

Matching Skills to Requirements

Carefully review the job description and identify the key skills and qualifications that the employer is seeking. Match your skills and experiences to those requirements, highlighting the relevant aspects of your background in your cover letter. Use keywords from the job description throughout your letter to demonstrate your understanding of the role and your ability to meet the employer’s needs. By aligning your skills with the employer’s expectations, you increase your chances of being selected for an interview. The best candidates are those who are able to directly provide evidence that they are qualified for the position.

Following Submission Guidelines

Pay close attention to the application instructions and submission guidelines provided by the employer. Ensure that you submit your cover letter in the requested format (e.g., PDF, Word document). Adhere to any specified word count limits or formatting requirements. Failing to follow the submission guidelines can lead to your application being overlooked. Following instructions carefully demonstrates your attention to detail and your respect for the employer’s process. If they require a specific format or have any instructions be sure to follow them to show you will be a good fit in the workplace.

Common Mistakes to Avoid

Avoiding common mistakes is essential for crafting an effective cover letter that makes a positive impression. By understanding the pitfalls to avoid, you can ensure that your cover letter effectively showcases your qualifications and increases your chances of landing an interview. Common mistakes can be easily avoided by paying attention to detail and being thorough with your application.

Generic Cover Letters

Using a generic cover letter that isn’t tailored to the specific job or company is a common mistake. Generic cover letters often lack the impact needed to capture the hiring manager’s attention and demonstrate your genuine interest in the role. Tailoring your cover letter to each application is crucial, demonstrating that you have researched the company and understand the requirements of the position. Personalize your letter by mentioning the company’s name, referencing their mission or values, and highlighting how your skills and experience align with their specific needs. The more tailored it is to the position the better your chances of landing an interview will be.

Typos and Grammatical Errors

Typos and grammatical errors can undermine your credibility and leave a negative impression on the hiring manager. Proofread your cover letter carefully for any errors in spelling, grammar, punctuation, and formatting. Use a grammar checker and consider having a friend or mentor review your letter before submitting it. A well-written and error-free cover letter shows attention to detail and professionalism. Ensure that your writing is clear, concise, and easy to read. Proofread the document several times.

Lack of Enthusiasm

A cover letter that lacks enthusiasm can fail to capture the hiring manager’s interest and enthusiasm. Express your genuine passion for actuarial science and your interest in the specific internship and company. Show your eagerness to learn and contribute to the company’s success. Use positive language, and highlight your excitement for the opportunity. Demonstrate your understanding of the industry and your motivation to pursue a career in actuarial science. This will show the hiring manager you are genuinely enthusiastic about the position.

Ignoring Company Culture

Failing to address the company’s culture and values can be a missed opportunity to make a connection with the hiring manager. Research the company’s culture and values and show how your personal values and work ethic align with those of the company. Mention any company initiatives or projects that resonate with you. This can also show your knowledge and research abilities. Demonstrate that you would fit in with the company’s work style and culture. Mention the company’s name in your letter to help show you care about their company.

Additional Tips for Success

To further enhance your chances of landing an actuarial internship, consider the following additional tips. These strategies can help you build your professional network, prepare effectively for the interview, and follow up after submitting your application.

Networking and Building Connections

Networking and building connections within the actuarial science community can significantly improve your job search. Attend industry events, career fairs, and networking sessions. Connect with actuaries on LinkedIn and other professional platforms. Seek out mentorship opportunities and learn from experienced professionals. Networking allows you to learn about job openings, gain insights into the profession, and expand your professional network. Networking can introduce you to professionals in the industry and provide connections that you can use in the future.

Preparing for the Interview

Prepare thoroughly for the interview by researching the company, reviewing common interview questions, and practicing your responses. Be prepared to discuss your skills, experience, and passion for actuarial science. Prepare to answer behavioral questions that assess how you have handled situations in the past. Demonstrate your problem-solving abilities by practicing technical questions. Dress professionally and arrive on time. Prepare questions to ask the interviewer, showing your interest in the role and the company. Prepare well and show them how you would fit into the role by preparing for the interview.

Following Up After Submission

After submitting your cover letter and resume, follow up with the hiring manager or the contact person to express your continued interest in the position. Send a brief, polite email a week or two after submitting your application, reiterating your enthusiasm and thanking them for their time and consideration. Following up shows your initiative and your interest in the opportunity. If you haven’t heard back within a reasonable timeframe, it’s acceptable to follow up once more. Do not be too persistent with this as it can be a negative factor for consideration.

In conclusion, a well-crafted actuarial intern cover letter is essential for landing your dream job. By understanding the role, showcasing your skills, avoiding common mistakes, and following the tips provided, you can significantly increase your chances of securing an interview. Remember to tailor your letter to each specific application, demonstrate your passion for actuarial science, and show your enthusiasm for the company. Good luck with your job search.